Overview

This basic SMSF Investment Property calculator will show how much you need to invest weekly and annually as well as how much capital gain you might get if you invest in property through a Self Managed Superannuation Fund (SMSF).

More and more people invest in property by establishing a Self Managed Superannuation Fund (SMSF) because owning a residential investment property within your SMSF can be significantly more tax effective than investing in a property in your personal name. This is because when a super account is in accumulation phase, the CGT tax rate is in effect only 10% if the property has been held for more than 12 months by the fund. Moreover, no CGT tax is payable if a super account is in pension phase (i.e. an individual is drawing a pension from the SMSF account).

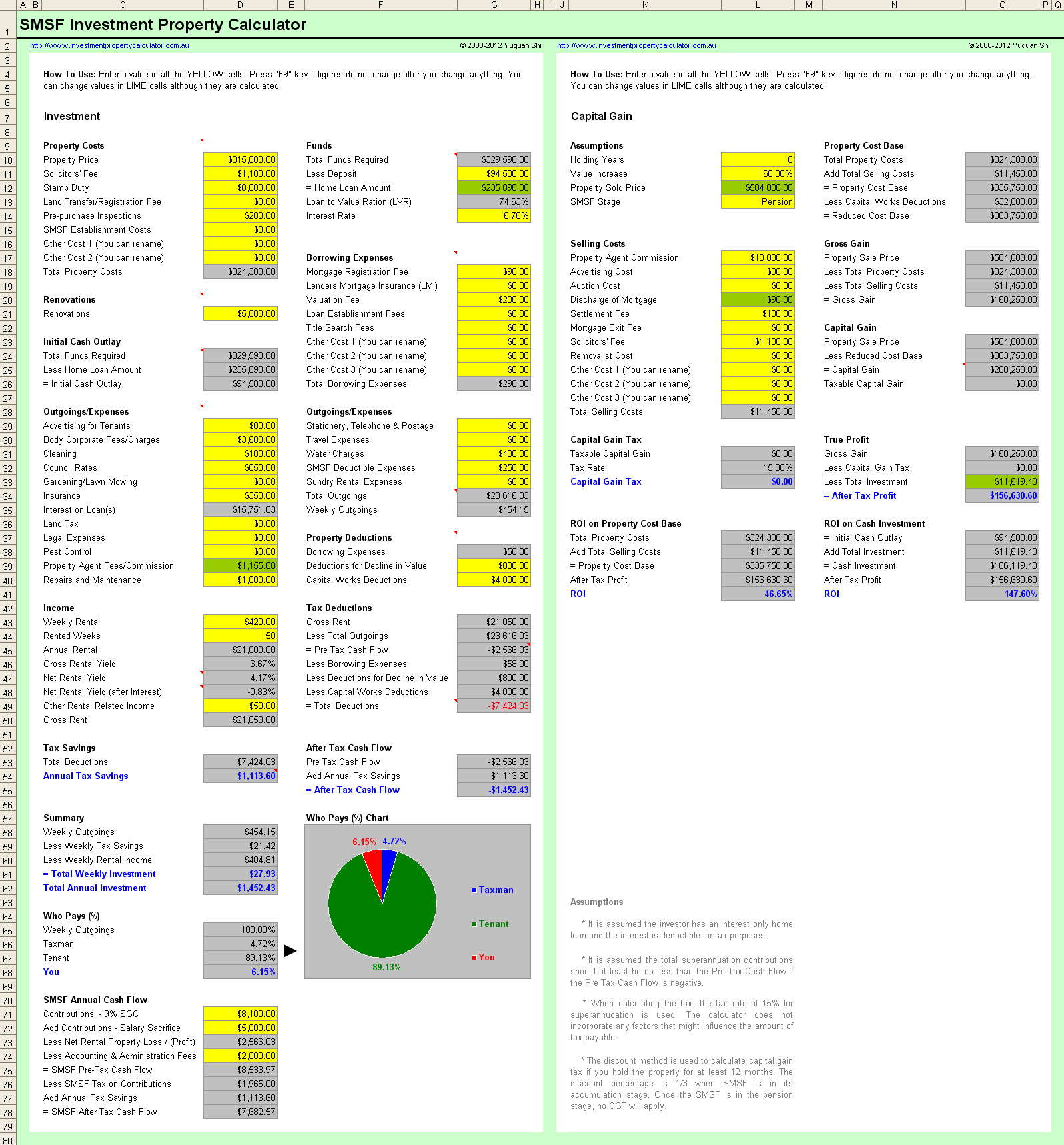

Here is a screenshot that will give you a better idea that what you need to do and what this SMSF Investment Property calculator can do for you.

Things You Need to Know

Please note that this free SMSF property investment calculator DOES NOT automatically populates all the government tax, duties, and the construction cost depreciation.

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Important Assumptions

Please note: This free SMSF investment property calculator is built based on the following assumptions.

(1) It is assumed the investor has an interest only (unless otherwise stated) home loan and the interest is deductible for tax purposes.

(2) When calculating the Capital Works Deductions, it assumes that the construction of the property started after 15 September 1987 and therefore the depreciation deduction is claimed for 40 years from the date construction was completed at a rate of 2.5% per year. Please note: You can manually adjust the depreciation deduction values from year to year if this assumption does not suit your situation.

(3) When calculating the tax payables etc, the tax rate of 15% applicable to superannuation contributions is used. The calculator does not incorporate any other factors that might influence the amount of tax payable, such as any rebates and deductions.

(4) If your superannuation account is in accumulation phase and the property has been held for more than 12 months by the fund, the discount method is used to calculate capital gain tax. The discount percentage is 1/3 (one-third) of the 15% tax (in effect, the CGT tax rate is 10%). If your superannuation account is in pension phase, that is, you’re receiving an income stream from your SMSF account, no CGT tax is payable.

(5) All months are assumed to be of equal length. One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.

Download FREE SMSF Investment Property Calculator