According to a recent poll on the Sydney Morning Herald, 1 in 2 of Australia mortgage holders are experiencing mortgage stress which means you spend more than 30 per cent of your pre-tax income on your home loan repayments. This ratio is much higher than the reported 3 in 10 mortgagors are facing mortgage stress from a recent ABS census.

It is important to know that how much you can borrow and how much you should borrow are two very different things.

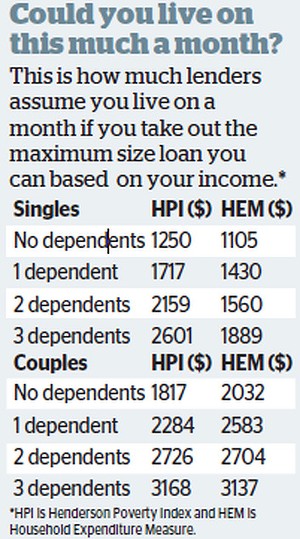

When calculating how much you can borrow, most if not all the major banks use a back-up measure of how much you need to pay them back and just scrape by, based on something called the Henderson Poverty Index and, more recently, the Household Expenditure Measurement.

I don’t think anyone can live a comfortable life on the amount suggested by the Household Expenditure Measurement shown here. If you are at this line you are essentially in baked-beans-for-dinner territory.

The right way to approach a home loan is to do a thorough budget. Once you have a good handle on what is coming in and going out – and where – then you can make a proper assessment of how much you can afford to repay, and therefore the size of the loan. You only need to borrow how much you should borrow.

You should use an independent calculator, such as the ones at moneysmart.gov.au or the free How Much Can I Borrow Calculator from Investment Property Calculator website, rather than the calculators on the banks’ websites.

Building a buffer into your budget is crucial. For example, What is you want to start a family or have more kids? What if you or your partner lost their job or got sick? Or if interest rates doubled?

You should definitely try to be realistic about what you’re buying to meet you and your family’s needs without having to get too big a loan.

They look to borrow €180,000 (90% loans are still the most popular amongst first time buyers) over 35 years (which is still the most popular term). Their gross income is €2,917 per month and their net income is €2,470. A loan of this amount would take up 41% of their disposable income according to the first AIB calculator, meaning they’d be turned down – even if they were paying more in rent and could prove that they were a good prospect.