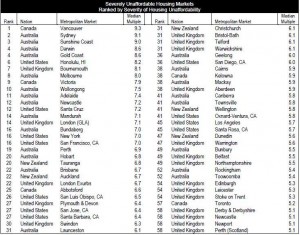

Australia has the most unaffordable housing market according to the Sixth Annual Demographia International Housing Affordability Survey published in 2010 (see the housing affordability index by country and housing affordability index scales below).

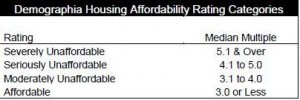

The survey looks at 272 metropolitan markets in Australia, the US, the UK, Canada, Ireland and New Zealand. Housing affordability is measured by using the Median Multiple (as shown in the table above), which is the median house price divided by the median household income.

12 out of the top 20 most unaffordable cities are in Australia. The least affordable cities are Sydney, Sunshine Coast, Darwin and Gold Coast, followed by Melbourne, Wollongong, Adelaide, Newcastle, Mandurah, Bundaberg, Perth, and Hobart (click the image below to see the full size table).

From a total of 23 Australian cities and regions included in Demographia’s 2010 International Housing Affordability Survey, 22 were labelled severely unaffordable.

You can download the Sixth Annual Demographia International Housing Affordability Survey 2010 here.

Thank you for this posting.

I wonder why this information should be that hard to find.

Thank you once again; I got the information I was looking for

Michael

Housing affordability in Australia is undeniably a serious issue. The National Rental Affordability Scheme is one way in which developers, investors and government are working together to address this problem.

So should we investigate buying overseas…like America…..until the Aus market recovers? I have been investigating a company that is advertising USA property…Am seriously considering it!

If by ‘recovers’ you mean ‘plummets’ then that might not be a bad option Simon. Having said that, USA is in dire straits, growing only slowly on the back of enormous amounts of printed money. There’s a reason that gold continues skyrocketing and it reflects investors’ complete lack of faith in the major economies right now.

Matt

Great comments, hope you are wrong. Why would anyone invest in America? In Germany at the time of the hyperinflation (1920s) when they were printing money anyone with a debt got off lightly and those with cash in the bank saw the value fall away to nothing.

It is great to invest in Europe. Nice places. Until Australia recovers, UK is a great place to go.

Demographia is a somewhat ideological organization with a domestic Australian agenda, viz, it seems to demonstrate that planning controls in the Australian residential property market make the Australian property market unaffordable, and should be reduced or done away with, altogether.

The analysis is fine as far as it goes, but it would be helpful to have a wider base of comparisons. Also “affordability”, the price / income ratio that demographia uses as a comparator, is a less reliable comparative yardstick than the price / rentals ratio, in our view, because locations differ widely in terms of affordability. It is rather obvious, for instance, that a densely-packed city where land and building permits are scarce, is likely to be less ‘affordable’, but this does not at all mean that residential property in the city is overvalued. To conclude that, you would do better to look at rental yields.