I read an article titled “7 questions to ask yourself before buying an investment property” somewhere on the Internet. The first question of the 7 questions is “Can I afford it?”

I suddenly realised that I have never done a blog post on how my website visitors could use my investment property calculators to help them in answering this very important question: Can I afford to buy an investment property?

I need to pick an investment property as the example. I decided to use one of the properties listed on Defence Housing Australia website as they normally come with a nice depreciation schedule which you cannot normally get from properties listed on Domain or Real Estate.

The Sample Investment Property

Here is the link to this property:

https://www.dha.gov.au/investing/buy-a-property/property-detail?pid=4204153

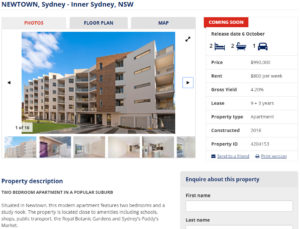

At the bottom of the property information page you can find this depreciation schedule for this property. I also captured the below screenshot of this property in case it will be removed from the DHA website.

It is an apartment in Newtown, Sydney with 2 bedrooms 2 bathrooms and 1 car space. The price is almost 1 million dollars with a rental income of $800 per week. Estimated outgoings include:

DHA Property Care service fee 13% – This is really high compared to the average 5.5% commission charged by real estate agents.

Water rates (p.a.) $697

Council rates (p.a.) $1,187

One large expense of apartment investment is the strata fee. I assume it will be $4,000 per year for this DHA property in Newtown.

The Numbers

I use the free investment property calculator Excel tool to crunch the numbers. You can find the information I used from this free investment property calculator example link.

The investors income assumptions are based on the full-time adult average weekly ordinary time earnings ($1,516.00) from Table 1: Average Weekly Earnings, Key Figures, Australia, May 2016 published by ABS. Based on the $1,516 weekly income I worked out the annual income will be $1,516 x 52 = $78,832. I choose this average annual income because I want to show if the average Australians can afford to buy a $1m investment property.

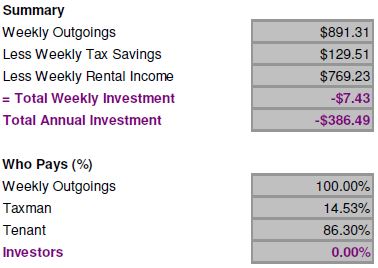

I assume the loan will be an interest only loan with an annual interest of 4.2%. This means at a 80% LVR (loan to valuation ratio), the investors need to borrow $792,000. The annual interest will be $33,284.

Let’s have a look at the result. For the purchase year, the investors will have an income of $7.43 per week. The tenant pays 86.3% of the total weekly outgoings while the tax refund pays 14.53% of the total weekly outgoings. Please note, the total is higher than 100% of the weekly outgoings and this is why there will be an income.

Do you think you can afford this investment property now? I don’t draw any conclusion here because I want you to think about:

- What if one of the investors lose their job?

- What if the interest rate goes up to 9%?

- What if the property price decreases to $800,000 and the bank asks you to top up the difference of $152,000?

- What if the government changes the tax deduction rules?

If you consider all the different scenarios, you might have a better answer to the “can I afford this property” question.

The Growth

Now let’s have a look at the possible return of this property after 10 years. In order to work out the future value of this investment property, I use the average growth rate from Domain data which is captured below. This chart shows the property value increase trend from 2010 to 2016.

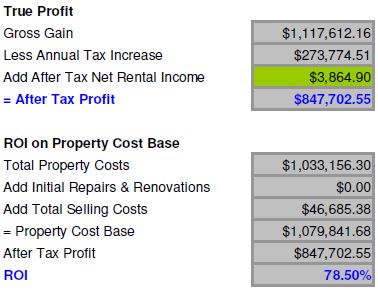

In Newtown, the average apartment price increased from $410,000 in 2010 to $661,000 in 2016. The average annual value growth rate is about 8.3%. Based on this growth rate in 10 years this property will be worth about $2,197,453! After all the tax etc, the investors could possibly get a net profit of $847,702. This may sound very good for lots of people.

In Newtown, the average apartment price increased from $410,000 in 2010 to $661,000 in 2016. The average annual value growth rate is about 8.3%. Based on this growth rate in 10 years this property will be worth about $2,197,453! After all the tax etc, the investors could possibly get a net profit of $847,702. This may sound very good for lots of people.

I want you to think about:

- What if the annual property value growth rate is 5%?

- What if the annual property value growth rate is only as same as the CPI, say 2.5%?

- What if the investors do not have any income when they sell the property?

- What if the government removes the capital gain tax discount?

The Details

If you want to see the yearly details like this property projection, please have a look at our Professional Investment Property Calculator as it will give you much more detailed information and the ability to fine-tune lots of the variables year on year across 30 years.

In addition the Professional Investment Property Calculator allows you to compare property investment to term deposit, share or the combination of term deposit and shares.