Find out why using Trust to own investment property – Passing through depreciation and capital works benefits

Perhaps one of the main reasons for trusts being favoured as a property investment vehicle, instead of a company, is its ability to pass on any net cash profit. These profits can be passed from the property that represents non-cash depreciation and capital works deductions, to the beneficiaries (or unit holders in the case of a unit trust).

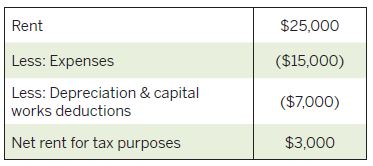

As an example, consider the annual net rent derived on an investment property as follows:

Given that the depreciation and capital works deductions are not ‘real’ cash expenses, the net cash available to the investor from the investment property will be $25,000 – $15,000 = $10,000.

If the investment property is owned by a company, the payment of the net cash profit of $10,000 to its shareholder will usually be treated as a taxable dividend.

However, if the investment property is owned by a discretionary trust, notwithstanding the fact that the trust has distributed the $10,000 in cash to its beneficiaries, the taxable distribution to the beneficiaries will be limited to $3,000, as the trust can essentially pass on the depreciation and capital works deductions to which it is entitled to the beneficiaries.

Given the other benefits associated with a unit trust, it is commonly used where there are multiple property investors from different families to the beneficiaries will be limited to $3,000, as the trust can essentially pass on the depreciation and capital works deductions to which it is entitled to the beneficiaries.

A unit trust has a similar ability to a discretionary trust in this regard but involves an additional level of complexity. Using the same example above, while the unit holders will only be assessed for tax on $3,000, the $7,000, being what is colloquially known as an ‘E4 amount’, will generally reduce the cost base of the units. As the cumulative E4 amounts distributed by the unit trust exceed the entire cost base of the units, any excess will give rise to a taxable capital gain in the hands of the unit holders.

It should be noted that the combination of this E4 mechanism and the requirement to reduce the cost base of the property when the unit trust sells the property by the cumulative capital works deductions to which it was entitled (if the property was acquired after 13 May 1997) could potentially give rise to double taxation, but this has been a known issue.

Given the other benefits associated with a unit trust, it is common, where there are multiple property investors from different families, to still use a unit trust to own their properties, despite this double taxation problem.