MANY people who bought houses on Melbourne’s fringes in recent years could be facing financial ruin after a slump in prices has left them owing more to the bank than their homes are worth which means they now have negative equity in their homes, experts have warned.

MANY people who bought houses on Melbourne’s fringes in recent years could be facing financial ruin after a slump in prices has left them owing more to the bank than their homes are worth which means they now have negative equity in their homes, experts have warned.

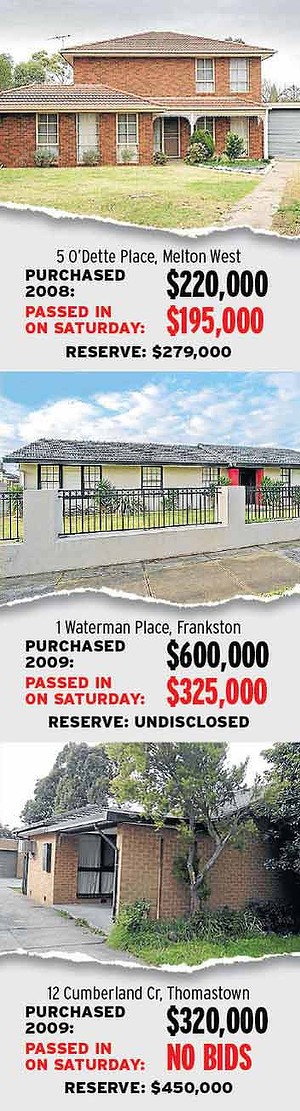

A three-bedroom brick veneer house in the western growth corridor suburb of Melton West was passed in at auction on Saturday at $195,000 – far short of its $279,000 reserve.

The owners paid $220,000 for the house in 2008.

Cases such as this have led some financial experts to warn of a ”depreciation time bomb” of negative equity for home owners in fringe suburbs, who owe more to the bank than the value of their homes.

New figures from Commonwealth Bank show the annual average pace of housing appreciation in Australia has been 1.8 per cent since the financial crisis, substantially below the 8 per cent average over the prior 20 years. It warned that a lower pace of appreciation was the ”new normal”.

”There is a risk that some purchase decisions that were made on the expectation of higher long-run average growth rates may have to be reassessed,” it said.

Property analyst Mark Armstrong predicted appreciation would be slowest for home owners in outer suburbs, who could see negative to zero growth in values for as many as 20 years.

”It’s the perfect storm of conspiring factors,” the director of iProperty Plan said. ”The average plot of land in the outer suburbs is [worth] half what it is in the middle suburbs and it is the land that appreciates, albeit slowly on the fringe. The houses they are building actually depreciate.

”On top of that, the quality of construction is often cheap. So that’s what’s behind the negative equity.”

Kevin Bailey, principal at Shadforth Financial Group, said his warnings three years ago of a ”homegrown subprime crisis”, created in part by inflationary first home buyer incentives, are now playing out. He said the schemes enticed mostly young people, without savings, to borrow heavily and pay a premium for low quality housing in poorly serviced locations.

”Lots of baby boomer parents who have made money out of property gave sage advice to children to pour their money into bricks and mortar because prices double every seven to 10 years,” he said.

”Young people who were sold that lie will find it very difficult to escape and it’s a tragedy.”

”They’ve probably got a couple of kids by now, haven’t had wage increases, utility prices have doubled, the carbon tax is coming in and their costs of living are going up,” he said.

”To top it off, no one is eager to buy their houses, so even if they try to sell out, chances are they’ll be taking a loss and still owe money.”

Despite the stockpile of a record 55,290 unsold homes in Melbourne in June, many developers are still offering 100 per cent finance, with no deposit to buyers.

Finance company the Dream Deposit is also offering a $5000 furniture package incentive for low-doc loans.

The head of the Master Builders Association, Brian Welch, admitted many buyers paid too much for land in the rush to take advantage of the generous first home buyer incentives that began in late 2008. He blamed slow land release at the time for creating an ”unhealthy price spike”.

”I’m surprised at the number of houses for sale, but it’s not a crisis,” he said. ”If there is an imbalance in the market, it will sort itself out over time and Victoria attracting its fair share of migrants is key to keeping people’s investments sound.”

Melbourne home prices recorded a 1 per cent rise in June to a median $480,000, as cuts to the official cash rate began to take hold, according to information from property research company RP Data-Rismark last week. However, prices were still down 6.6 per cent on a year ago.

(source: Domain)