Some of my friends asked me where they should put their money, specifically:

1. the offset account of their PPOR (principal place of residence) home loan or the offset account of their investment property loan?

2. a term deposit or the offset account of their PPOR (principal place of residence) home loan?

3. a term deposit or the offset account of their investment property loan?

I thus did a simple calculator to show them three different scenarios. You can download this Where I should put my money calculator here.

Let’s look at the three scenarios one by one.

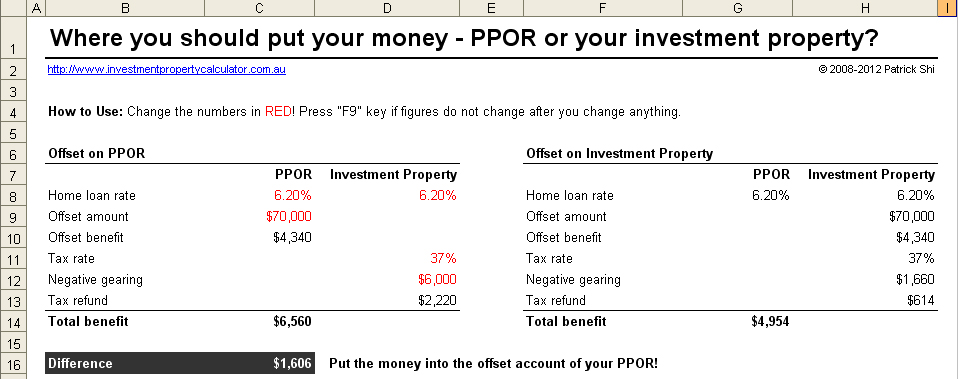

1. the offset account of their PPOR (principal place of residence) home loan or the offset account of their investment property loan?

Let’s have a look at the result below (you can click on the picture to see the large one). If you have $70k cash and your tax rate is 37%, putting the $70k into the offset account of your PPOR can save you about $1,606 per year so the answer is too obvious.

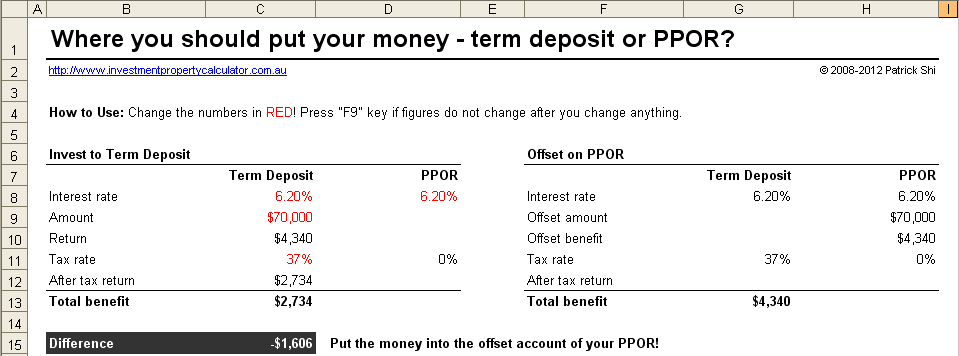

2. a term deposit or the offset account of their PPOR (principal place of residence) home loan?

The result below shows that if you put the $70k into the offset account of your PPOR you will be able to get about $1,606 more benefit per year so the answer is you should NOT do a term deposit.

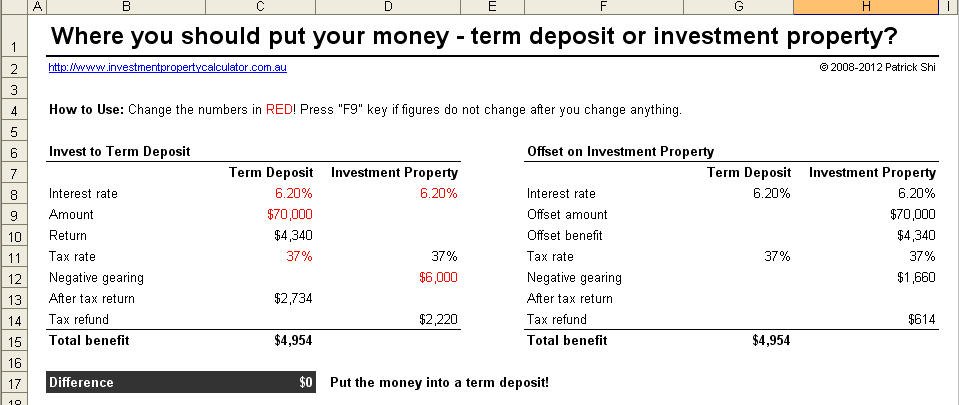

3. a term deposit or the offset account of their investment property loan?

The result below shows that there is no difference between putting the $70k into the offset account of your investment property and putting that into a term deposit if they have the same interest rate. In reality the term deposit interest rate will be normally lower than that of a home loan so the benefit you get from a term deposit should be lower.

You can download the sample reports generated by the Where I should put my money calculator from the links below:

Should I invest in Term Deposit or PPOR?