Australian property produced an average annual return of 5.3 per cent over the past 10 years to December 31, 2012.

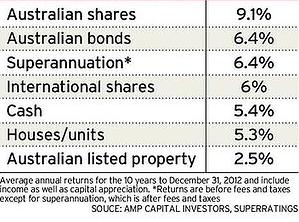

According to a SMH article, Australian shares produced an average annual return of 9.1 per cent over the past 10 years to December 31, 2012. Superannuation and Australian bonds were the next best performers, returning 6.4 per cent.

Bricks and mortar even struggled to keep up with the 5.4 per cent return on cash. Australian residential property produced a return of only 5.3 per cent.

Property price performance is even worse than it seems, because all returns given in the accompanying table (above, right) are ”total” returns. Estimates of the gross rental yield coming from rents have been added to the growth in house and unit prices. With shares, the dividends are included in the returns so the asset classes are compared like-for-like.