What the big 4 bank have done to us? They dig their profits from our pockets!

A study in the prestigious Economic Record has found that the big four Australian banks have on average passed on 116 per cent of each rate rise and only 84 per cent of each cut, using monthly Reserve Bank statistics on its cash rate and mortgage rates over the two decades to 2011.

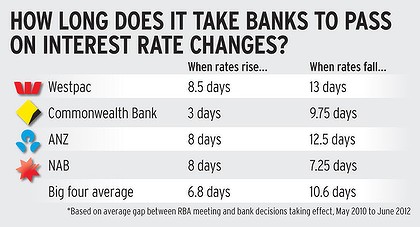

In addition, the study found that the banks typically slow and stingy about passing on cuts and fast and enthusiastic about more than passing on rate rises. The major banks have taken an average of 10.6 days to pass on rate cuts, but have raised rates on average after only 6.8 days, according to calculations by The Age. This is because they can get over $6.2 million from home loan owners for each day they delay in passing on any cut.

The following chart shows how long it took for the big four banks to pass on any interest rate changes.

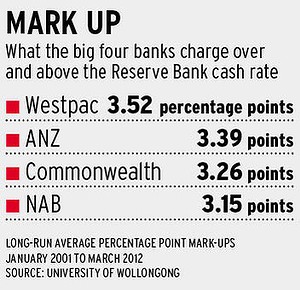

The big four banks also put an average mark up over the cash rate of 3.52 percentage points, as shown in the chart below.

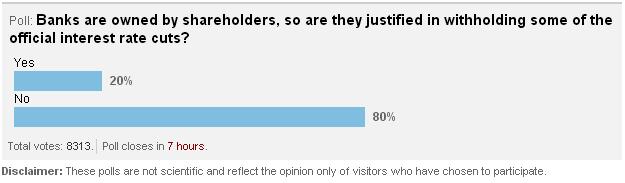

So how do Australia people feel towards the big four banks’ practice on interest rate? Here is the poll from smh.com.au.

Do you feel that the Australian people are being literally held up by the big four banks? I think you always have other options for your financial needs.