Property investors largely rely on capital growth for their returns and so if the perception is that housing prices have peaked and will remain flat, the sentiment shift could trigger the sale of properties, which will drive down prices. Will this happen?

According to the latest Investor Pulse survey conducted by Business Day and Colmar Brunton Research, flat house prices are not going to trigger large volume sales of properties.

The survey asked those property investors who held negatively gearing houses (which are the most dependent on capital growth for a return) what they would do if there was no capital growth for three years.

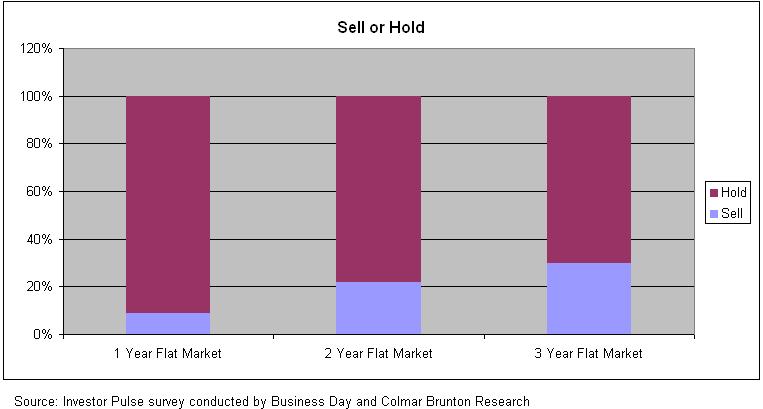

Nine per cent of investors with negatively geared investment properties said they would sell if the market was flat for one year. For two years of zero growth, another 13 per cent joined the selling. If the stalled market persisted for three years, another 8 per cent said they would sell. The remaining 70 per cent of investors with investment properties said that they would hold their investment through the stalled period and await future growth.

Here is the chart.

Will you sell or hold when the property market is flat for 3 years? I will hold because when I bought my investment properties the intention is to hold them for at least more than 15 years as the IRR of any investment property will reach the peak around the 18th year after you purchase them.