Overview

This Offset (Extra Repayment) Benefit Calculator is created to help you to understand (1) if you should make extra repayment to your owner occupied property or your investment property, or (2) if you should put your savings to the offset account of your owner occupied property or the offset account of your investment property.

Many Australians have both an investment property (IP) and a PPOR (principal place of residence, also known as owner occupied) property. One of the more frequently asked questions is "Shall I make extra repayment to PPOR or investment property (especially negative geared)?".

Some people would think we should always pay off higher rate loan first.

Some people suggest that after you discount the investment property interest rate by your tax bracket if it is still higher than your PPOR interest rate then you should first pay off your investment property debt. If that discounted rate is lower than your PPOR interest rate then pay off your PPOR first.

Some people say that we must pay off non-deductible debt first which means we need to pay off the PPOR loan first as the investment property loan is tax-deductible.

I think all the above mentioned could be correct but it really depends on your income, the interest rates, the rental income, etc. There is no right or wrong answer but the Offset (Extra Repayment) Benefit Calculator can provide you a much clearer view of the benefit from offset or extra repayment based on variables that you can tweak according to your own circumstances. With this Offset (Extra Repayment) Benefit Calculator you can run many different scenarios so you can be prepared if you want to get some independent financial advice or discuss it with your accountant.

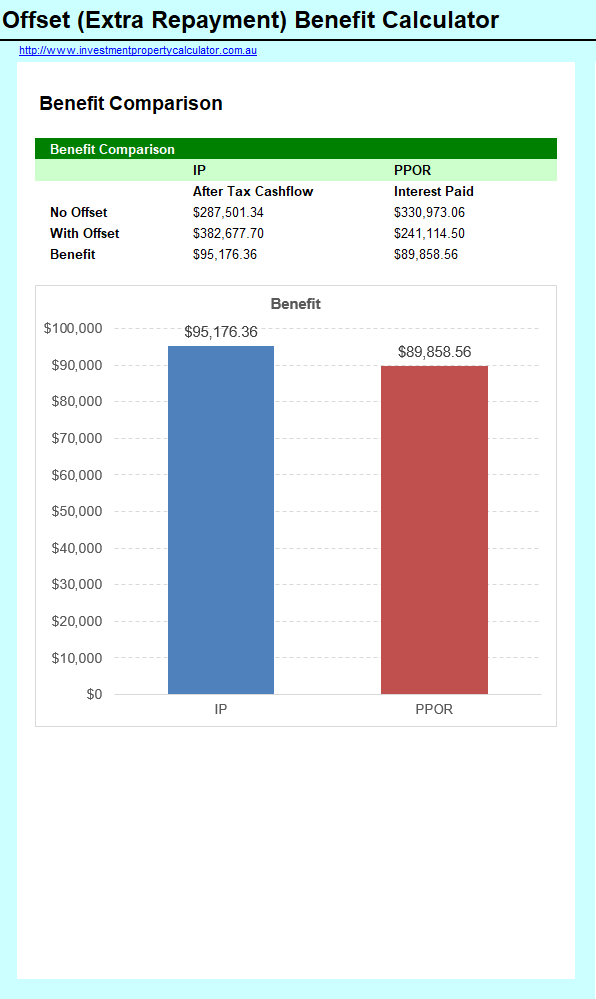

The most important thing is that we need to know how to measure the benefit of offset or extra repayment. For the investment property we need to look at the after tax cashflow difference between no offset / extra payment and with offset / extra payment. While for the PPOR we need to look at interest difference between no offset / extra payment and with offset / extra payment. Then we finally compare the two differences from investment property and PPOR to see which option brings more benefit.

This Offset (Extra Repayment) Benefit Calculator lets you experiment with many different scenarios by adjusting variables such as loan term, loan repayment frequency, interest rate, extra repayment / offset amount, etc.

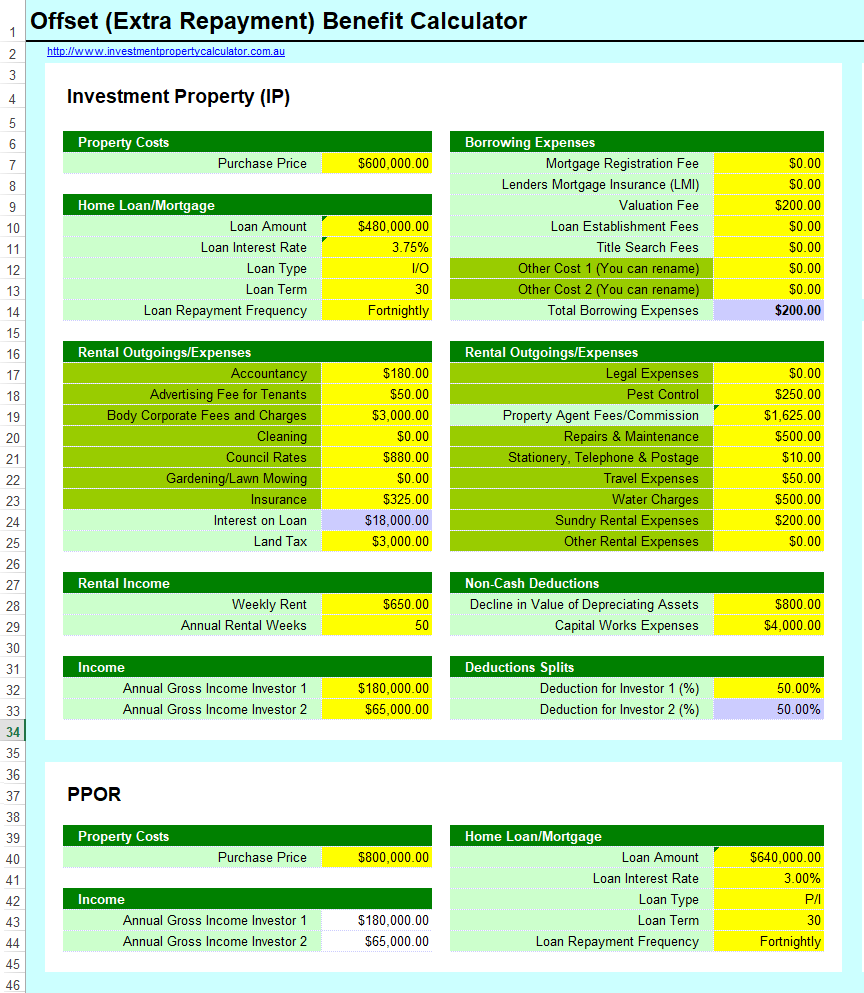

Here are some screenshots that will give you a better idea that what you need to do and what this Offset (Extra Repayment) Benefit Calculator can do for you.

Things You Need to Know

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Important Assumptions

Please note: This Offset (Extra Repayment) Benefit Calculator is built based on the following assumptions.

(1) All months are assumed to be of equal length. One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.