Overview

This Rentvesting VS PPOR Calculator Spreadsheet is a tool for up to 2 (two) investors to estimate which of rentvesting and purchasing PPOR possibly have better financial return in the long term.

Rentvesting is a property investment strategy where property investors buy an investment property and live in a rental property instead of purchasing their PPOR property. While there's a lot of debate on the financial pros and cons of rentvesting, it seems that the existing property investment analysis tools cannot estimate the return from rentvesting thus cannot compare the return with that of purchasing PPOR property first. This Rentvesting VS PPOR Calculator Spreadsheet is thus developed to show the return of both options over 30 years so you can estimate the long term financial benefit of them.

The Rentvesting VS PPOR Calculator Spreadsheet examines the three components of investment return for both rentvesting and PPOR purchase. The three components are after tax cash flow, after tax property capital gain, and after tax opportunity return.

After tax cash flow is simply the residual income generated by a real estate property investment once tax obligations have been fulfilled. For your investment property it can be positive or negative. A positive number indicates a profit (cash income), a negative amount indicates an after tax loss (holding cost). While for your PPOR property the after tax cash flow is normally negative because your PPOR property normally does not generate any income.

After tax property capital gain is the capital gain minus the tax you need to pay while the capital gain is the difference between what it cost you to obtain and improve the property (the cost base) and the amount you receive when you dispose of it. Of course you can make a capital gain or loss from selling your investment property. If you make a capital gain in an income year, you'll generally be liable for capital gains tax (CGT). If you make a capital loss, you can carry it forward and deduct it from your capital gains in later years.

After tax opportunity return is the after tax return you could have if you invest the money saved as the result of choosing one option over another between rentvesting and PPOR purchase. For example, the rentvesting costs $20,000 less in a year compared with the PPOR property. You invest the $20,000 into shares and have an after tax return of $1,000. This $1,000 is the opportunity return of your rentvesting strategy. While opportunity return can't be predicted with total certainty, taking them into consideration can lead to better decision making.

When comparing rentvesting and PPOR the Rentvesting VS PPOR Calculator Spreadsheet considers all the 3 components mentioned above. We believe it is a fair comparison only if we consider all the 3 components. If you think there are other things we need to conisder please do let us know.

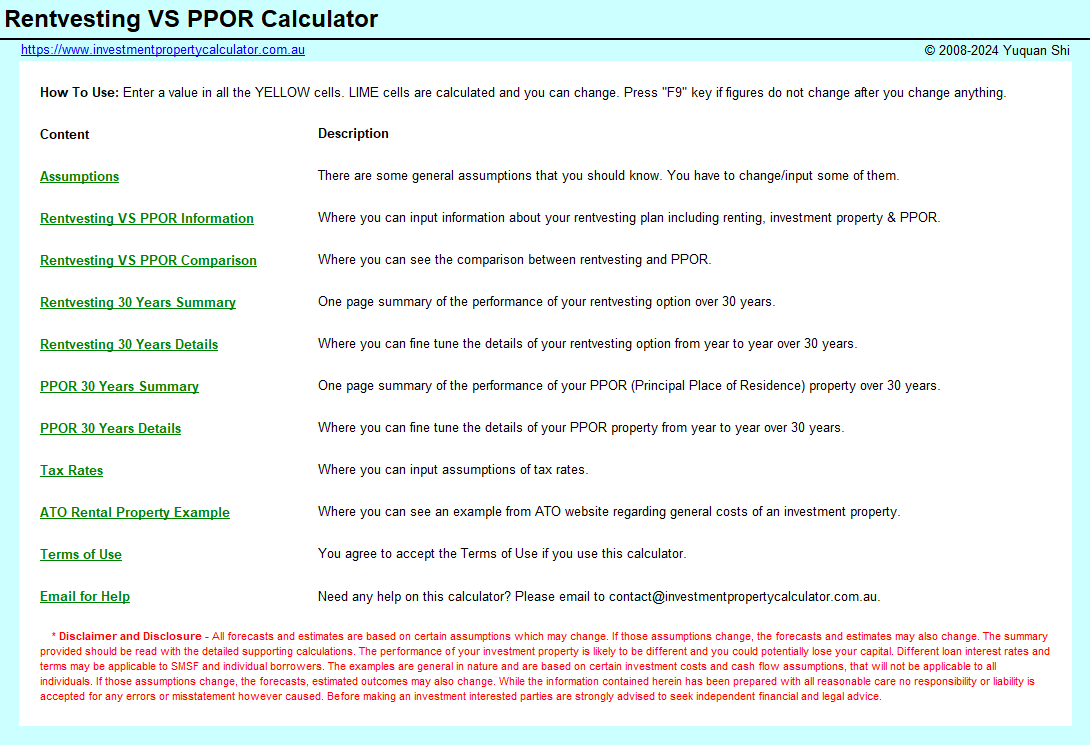

Here is a screenshot that shows what reports are provided in the Rentvesting VS PPOR Calculator Spreadsheet.

Main Features

This Rentvesting VS PPOR Calculator Spreadsheet caters for such variables as:

1. home loan type: P&I loans and I/O loans and switching between them;

2. home loan repayment frequency: monthly, fortnightly, or weekly:

3. home loan term up to 30 years;

3. P&I loans and I/O loans and switching between them, fixed interest loans, variable interest loans;

4. adjusting rental outgoings/expenses growth rate from year to year;

5. adjusting rented weeks & weekly rent from year to year;

6. adjusting rental percentage increases from year to year;

7. adjusting salary sacrifice (for example, superannuation contribution) rates from year to year;

8. adjusting renting cost increase rate from year to year;

9. purchase costs for both property and loan;

10. initial cash deposits on investment and PPOR properties;

11. variable capital growth rates for investment and PPOR properties and the ability to vary the capital growth rate from year to year.

Things You Need to Know

The Rentvesting VS PPOR Calculator Spreadsheet can estimate one investment property and one PPOR property. If you plan to build a property portfolio by purchasing multiple investment properties over a time period, the Ultimate Investment Property Calculator Spreadsheet will be the most useful tool that can help you plan your long-term property investment activities although it does not include any rentvesting calculation.

Let me see what the Rentvesting VS PPOR Calculator can do

This calculator is built in Microsoft Excel worksheet. You need to have Microsoft Excel® 2013 & Above for Microsoft Windows® OR Microsoft Excel 2016 & Above for Mac® to use it.

All the calculators (paid and free ones) on this website are password protected. We don't provide unprotected versions of the PAID calculators due to copyright reasons. If you purchase the paid calculators because you want to get the unprotected version please don't make the purchase as we are not going to provide unprotected copies. By purchasing the paid calculators you agree that no unprotected copies of the PAID calculators will be provided to you. If you don't agree please do not purchase. If you need the unprotected version of any FREE calculator a fee will apply. The advantage of the unprotected version is that you can freely edit the tool without any limit although we still own the copyright of the unprotected calculator. Please note you cannot redistribute our calculators without a written approval from us even for the ones with your modification or customization. In addition we are not going to provide any support on unprotected calculators with any modification or customization.

Important Assumptions

The Rentvesting VS PPOR Calculator Spreadsheet has the following assumptions. Certain assumptions listed here can be adjusted by the users.

(1) It is assumed the investor has an interest only (unless otherwise stated) home loan and the interest is deductible for tax purposes.

(2) When calculating the Capital Works Deductions, it assumes that the construction of the property started after 15 September 1987 and therefore the depreciation deduction is claimed for 40 years from the date construction was completed at a rate of 2.5% per year. Please note: You can manually adjust the depreciation deduction values from year to year if this assumption does not suit your situation.

(3) When calculating the tax payables, the tax rates applicable to Australian residents are used and the 2% Medicare Levy based on the individual Medicare Levy threshold is included where applicable. The calculator does not incorporate any other factors that might influence the amount of tax payable, such as Medicare levy surcharge, HECS contributions, any rebates, and deductions.

(4) The discount method is used to calculate capital gain tax if you hold the property for at least 12 months. The discount percentage is 50%.

(5) All months are assumed to be of equal length. One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.

(6) All the properties are assumed to be purchased and owned by individual investor(s) instead of trust or company or organization. If you plan to use the calculators for ownership other than individuals please do not purchase our calculators.

Sample Reports

You can download some sample reports in the Rentvesting VS PPOR Calculator Spreadsheet from the links below:

Information - Where you can input information about your rentvesting plan including renting, investment property & PPOR;

Return Comparison - Where you can see the return comparison between rentvesting and PPOR;

Rentvesting 30 Years Summary - One page summary of the performance of your rentvesting option over 30 years;

Rentvesting 30 Years Details - Where you can fine tune the details of your rentvesting option from year to year over 30 years;

PPOR 30 Years Summary - One page summary of the performance of your PPOR (Principal Place of Residence) property over 30 years;

PPOR 30 Years Details - Where you can fine tune the details of your PPOR property from year to year over 30 years.

If you have any questions please contact us we will get back to you within one hour during working hours.